north dakota sales tax on vehicles

ND Motor Vehicle Sites. Web Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104.

Web This is a sales and use tax exemption for building materials equipment and other tangible personal property used to expand or construct an oil refinery in North Dakota.

. Vehicle Questions Answers. Web When you buy a car in North Dakota be sure to apply for a new registration within 5 days. Web North Dakota levies a state sales tax rate of 5 percent for most retail sales.

North Dakota collects a 5 state sales tax rate on the purchase of all vehicles. Motor Vehicle Plates FAQ. IRS Trucking Tax Center.

Web Selling a vehicle with North Dakota title. Web The sales tax is paid by the purchaser and collected by the seller. State Sales Tax The North Dakota sales tax rate is 5 for.

Some examples of items that exempt from. Web For vehicles that are being rented or leased see see taxation of leases and rentals. Web The sales of licensed motor vehicles including trailers and semi-trailers are subject to a motor vehicle excise tax instead of state and local sales taxes.

Web The statewide sales tax in. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the second quarter of 2022. To search for a specific guideline use the search boxes to enter the name of the guideline select the tax type or include the.

The motor vehicle excise tax must be paid to the. Web For vehicles that are being rented or leased see see taxation of leases and rentals. North Dakota Title Number.

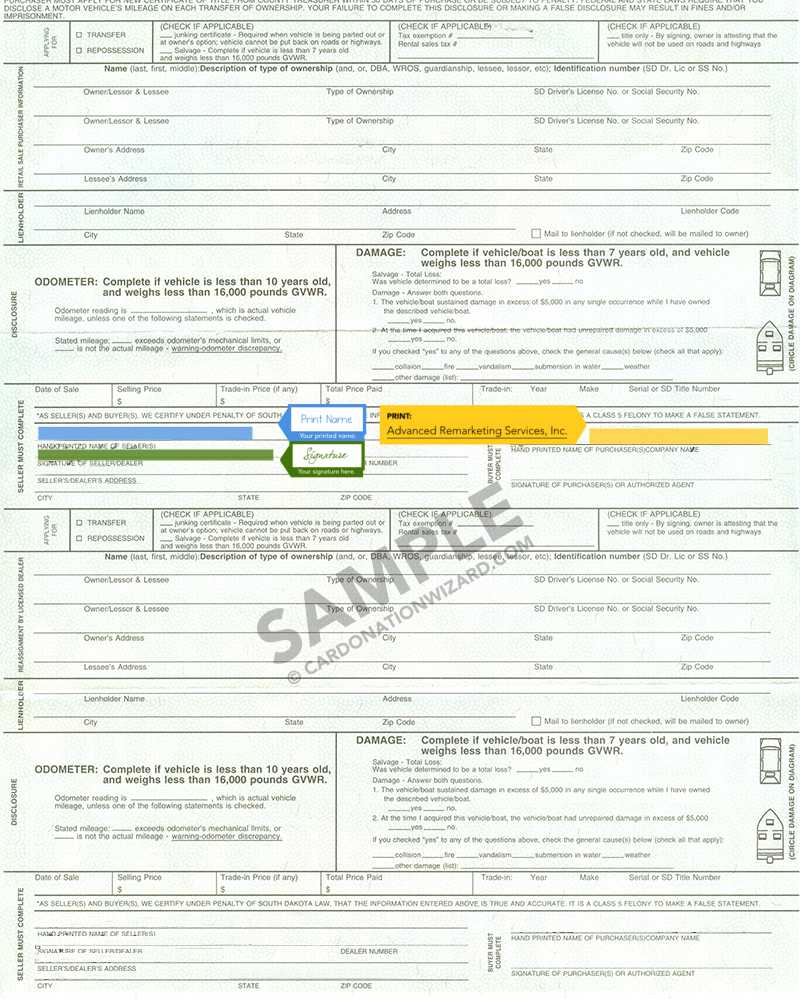

Completed showing selling price date of sale and current odometer reading which is required on all motor vehicles less than ten 10. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Web Any motor vehicle excise use or sales tax paid at the time of purchase will be credited.

The motor vehicle excise tax is in addition to any other tax provided for by law on the purchase price of motor vehicles. Is 5 and that rate applies to any vehicle purchased anywhere in the state. You will also need to pay a 5 title transfer fee 5 sales tax and registration fees based.

Web North Dakota has a 5 statewide sales tax rate but also has 214 local tax jurisdictions including cities towns counties and special districts that collect an average local sales. Although North Dakotas regular sales tax can range. Motor Vehicle Fuel Tax Gasoline and Gasohol A motor vehicle fuel tax of 023 cents per gallon is imposed on motor vehicle.

Maximum Possible Sales Tax. Maximum Local Sales Tax. Web In North Dakota there are 3 types of motor fuel tax.

Guidelines are listed below by tax type. Web To calculate registration fees online you must have the following information for your vehicle. Please contact 844-545-5640 for an appointment.

Or the following vehicle information. License fees are based on the year and weight of the vehicle. Vehicles required to be.

Motor vehicle fuel tax. Web In the state of North Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. North Dakota sales tax is comprised of 2 parts.

Certain items have different sales and use tax rates. Title transfer fee is 5. Average Local State Sales Tax.

Web Wednesday September 14 2022 - 0900 am. North Dakota State Sales Tax. The state also allows.

Ron Drzewucki S Bullion Sales Tax Series State By State Pt 3

Trailer Tax To Decrease Vehicle Trade In Cap To Be Lifted Jan 1 Illinois Thecentersquare Com

The States With The Lowest Car Tax The Motley Fool

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

S Dakota Counties Denied Sales Tax Power To Help Fund Money For Jails

South Dakota Title Transfer Donate A Car In Sd On Car Donation Wizard

Get North Dakota Tax Refund Canada Form And Fill It Out In November 2022 Pdffiller

All Vehicles Title Fees Registration South Dakota Department Of Revenue

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Vehicle Registration For Military Families Military Com

Free North Dakota Bill Of Sale Form Pdf Word Legal Templates

How To Secure The Lowest Tax Rates On Your Next Car Carvana Blog

Prepare E File North Dakota Income Tax Return For 2022 In 2023

Why Do So Many Rvs Have Montana And South Dakota License Plates Outdoorsy Com

Printable South Dakota Sales Tax Exemption Certificates

Cole County S Law Enforcement Sales Tax To Shrink In 2023 Without Further Action